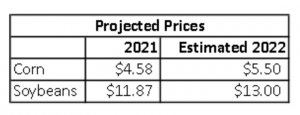

2022 Projected Prices for corn and soybeans are expected to be approximately $1 higher than in 2021. The 2022 December corn futures is tracking around $5.50 and November soybean futures around $13.00.

What does this mean for Revenue Protection?

In regards to coverage, a 200 APH with 85% RP coverage would have a $935 guarantee. This is $156 more than in 2021!

Higher prices = More revenue coverage

More revenue coverage = Higher Premiums?

Yes, this will most likely be true. Although, another contributing factor to watch is volatility. In 2021, we had much higher volatility factors than in recent years.

Using Estimated 2022 prices and “normal” volatility, premiums will be a few dollars higher than 2021 premiums. If the higher 2021 volatility is used, premiums would be closer to $6 per acre higher. Remember each database is unique and will have it’s own rate.

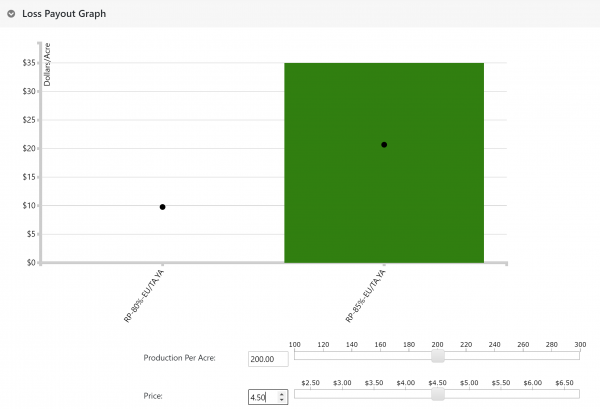

Here is an example of 2022 Revenue Protection Coverage and Potential Premium:

APH 200 bu. x Projected Price $5.50 x 85% RP = $935 guarantee

Enterprise Unit = $21 per acre

Optional Unit = $32 per acre

Locking in a high projected price provides good price protection and can trigger quickly in the event of declining prices by harvest.

Below is a Loss Payout Chart showing the Harvest Price dropping to $4.50:

You can see that the 85% RP coverage would trigger $35 per acre. The 80% coverage level would not trigger. The black dots represent insurance premium per acre.

Graph from Farmers Mutual Hail quoting system

Get Social