It has been almost 1 year since farmers purchased Margin Protection for the 2022 crop. At that time, corn prices were on the rise and locking in $5 corn looked very attractive heading into harvest. The fear of increasing input costs also weighed on many minds. Then February rolled around and corn prices were still on the rise. We locked in a $5.90 federal crop insurance corn price.

Knowing what we know now…

Was locking in Margin Protection at $5.06 last September a good idea?

Margin Protection is geared toward locking in a margin, not just a commodity price. The margin includes variable input costs.

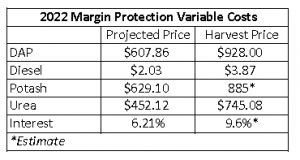

In 2022 the input costs have increased as follows:

(The harvest price for corn, interest, potash, and final yields are yet to be determined.)

Will 2022 Margin Protection Pay?

Below are a few scenarios to consider as we head into harvest.

Projected

Hardin Corn Trigger Margin $568.84

Harvest

Using same $5.06 corn price, 9.36% interest*, $885 potash*, and average yield 200.4

Hardin Corn Margin $568.84

Margin Protection Payout $67.77

Harvest – Change Corn Price to $6.25

Hardin Corn Margin Protection Payout $0

Hardin Corn Margin Protection with Harvest Price Option Payout $55.84

Electing the Harvest Price Option (HPO) will be key this year, if corn price is higher in the fall. Margin Protection with HPO would still have $55.84 payout, because you are guaranteed the higher price. If HPO was not elected, the higher harvest price could eliminate a payout.

Harvest – Change County Corn Yield to 205

Margin Protection Payout $44.49

Harvest – Change Corn Price to $6.25 and County Corn Yield to 205

Margin Protection HPO Payout $27.09

As you can see, locking in 2022 Margin Protection could still be beneficial due to the input protection feature of the policy.

Also read this articles for MP knowledge as you think about 2023 crop insurance protection:

Using Margin Protection for Price Protection

Get Social